鉅 亨 網 未成年開戶的問題,我們搜遍了碩博士論文和台灣出版的書籍,推薦Watson, Kevin,Honeybone, Patrick,Clark, Lynn寫的 Liverpool English 和Moore, Clement的 The Night Before Christmas Pop Up Book: A Pop-Up Edition都 可以從中找到所需的評價。

這兩本書分別來自 和所出版 。

國立政治大學 法學院碩士在職專班 劉定基所指導 王綱的 銀行業與保險業運用雲端服務與個人資料保護之合規研究 (2021),提出鉅 亨 網 未成年開戶關鍵因素是什麼,來自於雲端運算、委外雲端服務、個人資料保護、金融業委外雲端服務合約、金融機構作業委託他人處理內部作業。

而第二篇論文國立成功大學 法律學系碩士在職專班 顏雅倫所指導 黃韋巖的 論開放銀行下的三面關係–以消費者賦權為中心 (2020),提出因為有 金融科技、開放銀行、資料可攜權、消費者資料權、消費者賦權的重點而找出了 鉅 亨 網 未成年開戶的解答。

Liverpool English

為了解決鉅 亨 網 未成年開戶 的問題,作者Watson, Kevin,Honeybone, Patrick,Clark, Lynn 這樣論述:

The Dialects of English series provides concise, accessible, authoritative and up-to-date documentation for varieties of English, including English-based pidgins and creoles, from all over the English-speaking world. Written by experts who have conducted first-hand research, the volumes are the m

ost obvious starting point for readers who would like to know more about a particular regional, urban or ethnic variety. The volumes follow a common structure, covering the context in which one clearly defined variety of English (or a number of closely related varieties) has been established as well

as their phonetics and phonology, morphosyntax, lexis and social history. Each volume concludes with an annotated bibliography and some sample texts. Previous volumes are listed below. Recent and forthcoming volumes are listed on the Volumes tab. Robert McColl Millar, Northern and Insular Scots (20

07) David Deterding, Singapore English (2007) Jennifer Hay, Margaret A. Maclagan & Elizabeth Gordon, New Zealand English (2008) Sailaja Pingali, Indian English (2009) Karen P. Corrigan, Irish English, Volume 1: Northern Ireland (2010) Sandra Clarke, Newfoundland and Labrador English (2010) Jane

Setter, Cathy S. P. Wong & Brian H. S. Chan, Hong Kong English (2010) Joan C. Beal, Lourdes Burbano Elizondo & Carmen Llamas, Urban North-Eastern English: Tyneside to Teeside (2012) Urszula Clarke & Esther Asprey, West Midlands English: Birmingham and the Black Country (2012) Advisory Bo

ard: David Britain (University of Bern, Switzerland) Kathryn Burridge (Monash University, Australia) Jenny Cheshire (Queen Mary University of London, United Kingdom) Alexandra D’Arcy (University of Victoria, Canada) Lisa Lim (The University of Hong Kong, China) Rajend Mesthrie (University of Cape To

wn, South Africa) Peter L. Patrick (University of Essex, United Kingdom) Peter Trudgill (University of Fribourg, Switzerland) Walt Wolfram (North Carolina State University, USA) To discuss your book idea or submit a proposal, please contact Natalie Fecher. For further publications in English linguis

tics see also our Topics in English Linguistics book series.

銀行業與保險業運用雲端服務與個人資料保護之合規研究

為了解決鉅 亨 網 未成年開戶 的問題,作者王綱 這樣論述:

雲端運算自2010年開始商業化迄今已逾10年的發展,隨著資訊技術在軟硬體方面的革新、網際網路效能提升和新興行動科技的問世,無論是在雲端服務的模式(如SaaS、PaaS、IaaS)或是架構(如公有雲、私有雲、混和雲與社群雲)上都逐漸成熟,也使雲端運算在各領域(例如:公部門、醫療、金融、物流等)的運用漸成為趨勢。銀行業與保險業在雲端運算的運用上之前多以私有雲來進行 (例如巨量資料分析、區塊鏈的智能合約、智能客服等),主因是考量法規依據與個資保護等議題,所以對於委外雲端服務大多在評估階段。2019年9月30日完成「金融機構作業委託他人處理內部作業制度及程序辦法」修訂後,銀行業與保險業在委外雲端的運

用上有較明確的法規依據。日後便可依照相關辦法中所規範的原則建立委外雲端服務的系統架構。金融機構運用雲端服務的個資保護議題除了與「個人資料保護法」及「個人資料保護法施行細則」有關外,「金融機構作業委託他人處理內部作業制度及程序辦法」、「金融監督管理委員會指定非公務機關個人資料檔案安全維護辦法」、「保險業辦理資訊安全防護自律規範」等都是需要遵守的法規規範。在委外雲端服務的運用上若要符合個資保護的相關規範,就必須在委外雲端服務的合約中訂立適當的條款。合約中對於委外雲端作業的風險控管、委託者的最終監督義務、主管機關和委託者的實地查核權力、查核方式、資料保護機制、受託者權限管理、資料儲存地點及緊急應變計

畫等都應在委外雲端服務合約中載明,以利個人資料保護的執行。本篇論文以此想法為出發點,並以目前委外雲端服務中較具規模業者的合約為討論對象,說明一般委外雲端服務合約對於相關法規的涵蓋程度。

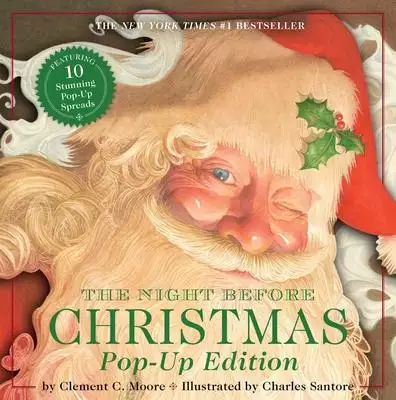

The Night Before Christmas Pop Up Book: A Pop-Up Edition

為了解決鉅 亨 網 未成年開戶 的問題,作者Moore, Clement 這樣論述:

This magnificent Christmas Eve poem is brought to life in this pop-up edition of the #1 New York Times best seller The Night Before Christmas. ’Twas the night before Christmas, when all through the house, Not a creature was stirring, not even a mouse... This holiday season enjoy everyone’s favor

ite Christmas Eve poem with this beautiful pop-up book. Every child knows the words to this captivating story, and this delightful edition provides an exciting 3D reading experience for children and parents alike. Join Dasher, Dancer, Prancer, Vixen, Comet, Cupid, Donder, and Blitzen and dash your w

ay through these dynamic pages. Not only will this Christmas poem spread holiday cheer, it will engage your child and encourage a love of reading. This edition includes: - 3D pop-up elements that offer a new take on this nostalgic Christmas classic - A beautifully designed hardcover with an embosse

d foil-stamped cover - Clement C. Moore’s original text, including a nod to Dutch references in the poem, specifically the Dutch name "Donder," which translates to "thunder" - Stunning artwork by #1 New York Times best-selling illustrator Charles Santore. Start a new family tradition this year or

carry on your own with this illuminating edition of a timeless tale. You’ll be sharing this holiday classic with children and family for years to come. The work of New York Times bestselling children’s book illustrator Charles Santore has been widely exhibited in museums and celebrated with recognit

ions such as the prestigious Hamilton King Award, the Society of Illustrators Award of Excellence, and the Original Art 2000 Gold Medal from the Society of Illustrators. He is best known for his luminous interpretations of classic children’s stories, including The Little Mermaid, Alice’s Adventures

in Wonderland, Snow White, and The Wizard of Oz.

論開放銀行下的三面關係–以消費者賦權為中心

為了解決鉅 亨 網 未成年開戶 的問題,作者黃韋巖 這樣論述:

近年來科技進步十分迅捷,且伴隨新興科技的實際應用加深加廣,對於人們日常生活所生的改變與影響亦隨之增大,尤其是科技應用於金融產業所致的影響更為顯著,並催生「金融科技」的概念,例如大數據分析、人工智慧以及開放銀行等,皆屬之。此外,亦可發現前述金融科技的應用實多與「資料」相涉,而金融市場中所有資料多係源自於消費者的個人資料,如此使得其個人資料於金融市場中變得愈來愈具價值,更使各國政府日趨重視其個人資料的保護。承前述,近期諸多金融科技應用當中,「開放銀行」無疑地於世界各地銀行業的生態系中蔚為風尚,亦為本文所欲探討的對象。惟開放銀行對於所有金融市場參與者而言,實際上所帶來的不僅僅為便利與機會而已,亦同

時帶來相當程度的挑戰與風險。是以,開放銀行之推動施行前實有深加探究相關問題之餘地,諸如應以強制方式或自願自律方式來推動、應否藉由修法強化資料權利來增進消費者控制個人資料之地位、應如何界定開放銀行下的資料開放範圍、第三方業者應如何納管以及應如何緩解銀行業者在開放銀行運作下所面臨銀行法保密義務之衝突等。爰此,本文經參酌英國、歐盟、澳洲、新加坡以及香港等地區有關開放銀行法制的架構以及個人資料保護相關規範的制定,認為面對我國當前開放銀行的發展環境,實尚有不足之處,並提出應將資料可攜權之概念予以明文化,且應建立消費爭議之專責受理申訴平台,並設置審查或驗證第三方業者的專責機構等建議,以期我國加速推動開放銀

行發展的同時,能兼顧消費者權益之保障,進而貫徹消費者賦權之核心理念。